Hi I'm a Australian cam girl and I have been on Myfreecams for a year and a half only within the last couple months I have taken it more seriously and it has been worth it to me to consider investing more time and actually saving money, however I have some questions regarding how tax works for cam girls and any advice would be fantastic.

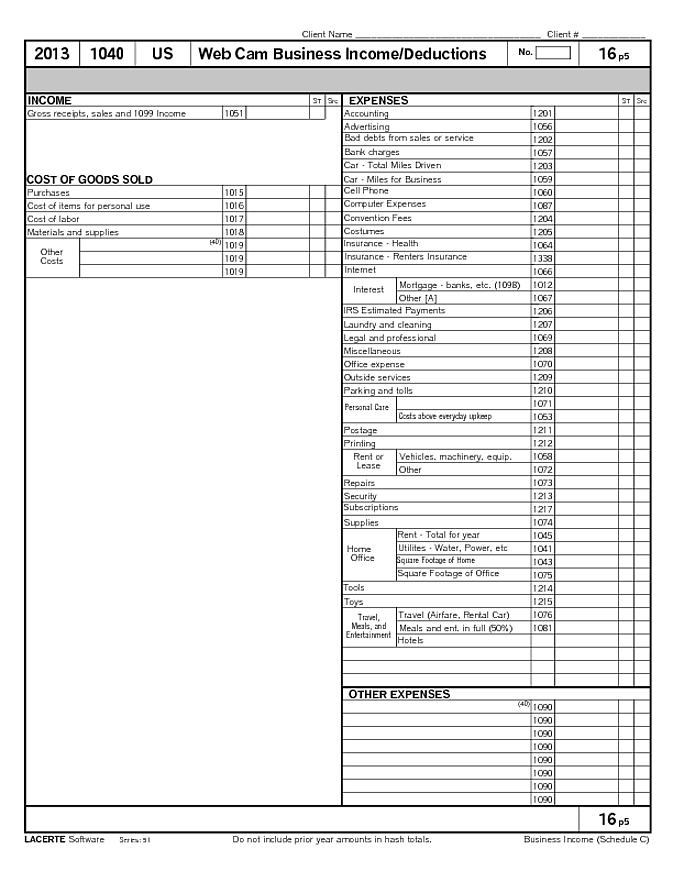

Can anyone provide any detail on what kind of things you can claim on tax?

and any other information you may think can be useful?

Thank you so much for taking the time to shed some light xx

Can anyone provide any detail on what kind of things you can claim on tax?

and any other information you may think can be useful?

Thank you so much for taking the time to shed some light xx