yes so make it legal put that id code tax . and with ur friend u receve money in company or what u have and u both pay taxes half ., i do the same with my friend . .. about 2023 noone knows yet , some girls wanna go to taxes and fill a paper that they made an amount of money online and to report it and pay taxes for 2023 .. other just pray to god noone gonna ask nothing from taxes about 2023 ..

AmberCutie's Forum

An adult community for cam models and members to discuss all the things!

dac7

- Thread starter model2023

- Start date

-

** WARNING - ACF CONTAINS ADULT CONTENT **Only persons aged 18 or over may read or post to the forums, without regard to whether an adult actually owns the registration or parental/guardian permission. AmberCutie's Forum (ACF) is for use by adults only and contains adult content. By continuing to use this site you are confirming that you are at least 18 years of age.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

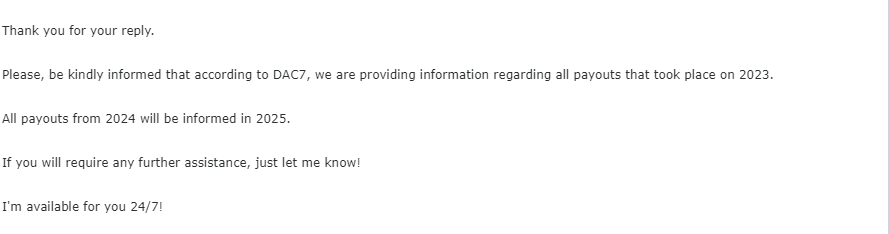

about stripc\hat they responded me that they will report for 2023 and also all earnings,those under 2000 euro too

if they want id tax stop losing time asking online , go ask an accuntant how to receve ur money and get id tax , then u can receve new payments .. usually takes 5 days to get a company done or dunno where u from how works .

about ur second question, if mfc or cb report or not, u better get leggal, send all incomes in bank legal, pay tax, even if they report now or later or not . like this u wont get in troubles .

about ur second question, if mfc or cb report or not, u better get leggal, send all incomes in bank legal, pay tax, even if they report now or later or not . like this u wont get in troubles .

- Jan 27, 2020

- 508

- 3

- 1,806

- 61

- Twitter Username

- @mika_kedi

- MFC Username

- mikakedi

- Chaturbate Username

- mika_kedi

- Clips4Sale URL

- https://www.clips4sale.com/studio/191561/mika-kedi

Just wanted to add that you don't have to have a company to have a tax ID, individuals pay taxes also and have something to use as tax ID. So depending on the tax law in your country and how much you're earning you may not need to open a company. But yeah, instead of expecting other models to find a magical solution for you and acting annoyed when you don't get answers you want just start paying your taxes.

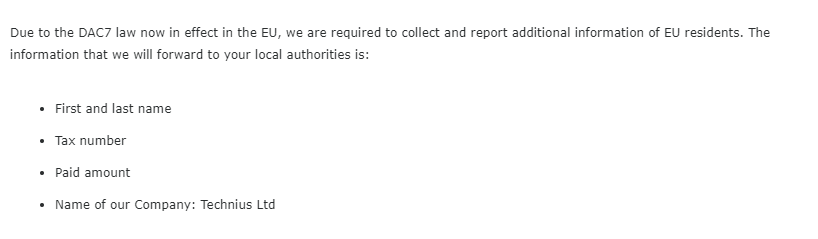

Yes, mfc require Tax id. You need go to change payment info section and you will see. What is interesting, i saw this change on friday and on sunday i normally requested early paymnt with success and i didnt yet give my tax id. When we ask them for details: if they will report or for which year- they keep sending same message :

Please reach out to your local tax authority for more information.

Please reach out to your local tax authority for more information.

Btw im in Poland and our tax id can be PESEL. And PESEL is on our ID, so you need get information what is tax id in your country.Yes, mfc require Tax id. You need go to change payment info section and you will see. What is interesting, i saw this change on friday and on sunday i normally requested early paymnt with success and i didnt yet give my tax id. When we ask them for details: if they will report or for which year- they keep sending same message :

Please reach out to your local tax authority for more information.

- Jan 27, 2020

- 508

- 3

- 1,806

- 61

- Twitter Username

- @mika_kedi

- MFC Username

- mikakedi

- Chaturbate Username

- mika_kedi

- Clips4Sale URL

- https://www.clips4sale.com/studio/191561/mika-kedi

It makes sense. Even though every EU country was supposed to have regional dac7 legislation ready from the beginning of 2023 some countries were late and some (Poland for sure, idk if any other too) still don't have it passed over a year later, so can't require the info yet. That doesn't mean MFC (or other sites) won't collect it. They will since they send all data to EU and then EU distributes it between local tax authorities according to regional laws.they keep sending same message :

Please reach out to your local tax authority for more information.

At least that's what I read and understood, I'm not a lawyer or any other kind of specialist on the subject. I recommend looking for yourselves for the info about your respective countries or consulting a specialist if you need/want to know more.

WOah finally somebody explained me this with sense! Respect! You are not lawyer but what you saying is totally logical.It makes sense. Even though every EU country was supposed to have regional dac7 legislation ready from the beginning of 2023 some countries were late and some (Poland for sure, idk if any other too) still don't have it passed over a year later, so can't require the info yet. That doesn't mean MFC (or other sites) won't collect it. They will since they send all data to EU and then EU distributes it between local tax authorities according to regional laws.

At least that's what I read and understood, I'm not a lawyer or any other kind of specialist on the subject. I recommend looking for yourselves for the info about your respective countries or consulting a specialist if you need/want to know more.

mika, thats so true,, i talked today to my jurist, she told me exactly the same .. all data will go to EU and from there to each country ..

model not our problem u dont understand english . We keep telling u doesnt matter if sites report now or in december or they ask tax id or not, u go get legal , end of story , they dont need to ask u any tax number in order to pay ur taxes , go find the way to pay taxes for the money u get

model not our problem u dont understand english . We keep telling u doesnt matter if sites report now or in december or they ask tax id or not, u go get legal , end of story , they dont need to ask u any tax number in order to pay ur taxes , go find the way to pay taxes for the money u get

Stripchat removed my payment method and dont let me add another one without TIN number, VAT number and other ' legal details' !!!!

U just noticed this? They were advertising it i think 2 weeks agoStripchat removed my payment method and dont let me add another one without TIN number, VAT number and other ' legal details' !!!!

I ve seen nothing on my mail and profile

U just noticed this? They were advertising it i think 2 weeks ago

its in the news section from long time, also message from support: they will report all earnings, including 2023I ve seen nothing on my mail and profile

i mean all , also those under 2000 euroits in the news section from long time, also message from support: they will report all earnings, including 2023

Do you think you could put more effort into your posts to be more clear on what you’re looking for?Around look report method payment too?

All payouts ( also those under 2000 euro) and for 2023 tooUnfortunatly have other detail and i think they report all. But can't understand american platform what they do

Attachments

The account that receives the income from the cam site directly is the one that gets it reported by the cam site. That was already covered in this thread I believe.Mah. Difficult. Lots account multiple performer non only 1 beneficiary. Someone can be cancel in 2023 2024...

- Jan 27, 2020

- 508

- 3

- 1,806

- 61

- Twitter Username

- @mika_kedi

- MFC Username

- mikakedi

- Chaturbate Username

- mika_kedi

- Clips4Sale URL

- https://www.clips4sale.com/studio/191561/mika-kedi

There is no confusion if you can read, use search engines and think. You don't even need to have good understanding of English, I found all the info in my native language very easily since dac7 affects all online platforms doing business in the EU, not just adult ones, so there is plenty written about it on the internet.Too much confusion about dac7. Platform keep information? Send information? How about 2023 with 2024 information tax? What's exact details the keep?

KingMarti

Cam Model

- Jul 9, 2017

- 5,313

- 3

- 9,402

- 213

- Twitter Username

- @KingMartiCam

- Streamate Username

- Thekingmarti

- Chaturbate Username

- KingMarti

...I ear some models....under studio...studio take 50% + tax....but now sites report model for tax

if a model works for a studio they dont get paid by the site, the studio does, so the site would report the studio's earnings.

- Status

- Not open for further replies.

Similar threads

- Replies

- 1

- Views

- 179

-

- Locked

- Poll

- Replies

- 0

- Views

- 853

- Replies

- 5

- Views

- 261

- Replies

- 1

- Views

- 227