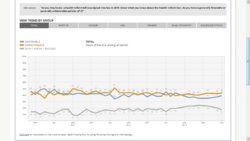

Views on the law: Most Americans don’t like it.

In every poll conducted by eight major national pollsters this year, opposition to the Affordable Care Act outweighs support.

http://www.american.com/archive/2013/oc ... e-care-act

Medicare & Medicaid Fraud

http://www.cato.org/publications/congre ... ealth-care

Medicare and Medicaid are rife with fraud and other types of improper payments. The Centers for Medicare and Medicaid Services estimates that Medicare made at least $48 billion in improper payments in 2010.9 That figure does not include improper payments in Part D, which auditors believe is also highly susceptible to abuse.10 Nevertheless, $48 billion amounts to more than 9 percent of total Medicare spending and nearly four times the combined profits of private health insurance companies.11 CMS also estimates that the federal government alone made $22.5 billion in improper Medicaid payments in 2010, making the combined total of improper payments in the two programs somewhere north of $70 billion per year.12 In one infamous case, a New York dentist once billed that state’s Medicaid program for 991 procedures in a single day. In 2005, the New York Times reported that New York’s Medicaid program “has become so huge, so complex and so lightly policed that it is easily exploited,” and that “a chief state investigator of Medicaid fraud and abuse in New York City said he and his colleagues believed that at least 10 percent of state Medicaid dollars were spent on fraudulent claims, while 20 or 30 percent more were siphoned off by what they termed abuse, meaning unnecessary spending that might not be criminal.”13 Some experts estimate that improper payments are even more prevalent in these programs. Harvard University’s Malcolm Sparrow estimates that improper payments account for 20 percent of spending in federal health care programs.14 That suggests Medicare alone makes $100 billion in improper payments annually. The Government Accountability Office has for two decades designated both Medicare and Medicaid as posing a high risk for fraud.15 Decades of congressional efforts to combat Medicare and Medicaid fraud have proven largely fruitless and even harmful to patients, as my colleague Prof. David Hyman explains in his satirical book Medicare Meets Mephistopheles, an excerpt from which I have attached as an appendix.16

Medicare fraud is not confined to the behavior of criminals and a few health care providers.17 Elected and unelected officials, in both legislative and executive branches of the federal government, routinely defraud the American public by pretending that the so-called Medicare trust funds contain assets that may be used to pay future Medicare benefits.18 As the Clinton administration explained in its 2000 budget submission, the “balances” in the Medicare and Social Security trust funds “do not consist of real economic assets that can be drawn down in the future to fund benefits … The existence of large trust fund balances, therefore, does not, by itself, have any impact on the Government’s ability to pay benefits.”19 Congress and the White House, under the control of both parties, have also defrauded the American people by using budgetary gimmicks that hide the full cost of Medicare. These fraudulent gimmicks include the legislated reductions in Medicare payments to physicians under the Balanced Budget Act of 1997 and Part A providers under the Patient Protection and Affordable Care Act of 2010. Such spending reductions are so politically implausible that Congress routinely rescinds them. Yet their inclusion in statute makes Medicare appear less costly than it actually will prove to be in a 10-year budget window and beyond. This type of fraud has become so routine that the Congressional Budget Office attempts to correct for it by projecting future Medicare outlays based on current policy (assuming that Congress rescinds the spending reductions) as opposed to current law (which assumes the reductions will take effect)