Yes unfortunatelly i didnti'm sorry that you have lot's money freeze on choice bank

i know you i see you lot's time streaming lot's months

so I think you have never withdraw from choice bank....

AmberCutie's Forum

An adult community for cam models and members to discuss all the things!

What is going on with First Choice?

- Thread starter MiaFoxUK

- Start date

-

** WARNING - ACF CONTAINS ADULT CONTENT **Only persons aged 18 or over may read or post to the forums, without regard to whether an adult actually owns the registration or parental/guardian permission. AmberCutie's Forum (ACF) is for use by adults only and contains adult content. By continuing to use this site you are confirming that you are at least 18 years of age.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Yea but very bad timeframe...wtf 2 monthsOk, that's the situation when the bank reopens and there is a bank run. The liquidity coverage is 75%. If the bank opens again, they have to pay you with you request. If you're first, you're lucky. But if you request the last 25% of the whole capital deposited at the bank (so not only Fcp), you're unlucky.

I read in some email from Ad Kees here, they are increasing that 75%. They can do this by selling assets as fast as possible like you describe too. So this new info is not contradictory to what Ad wrote.

Thanks for this info.

Yea but very bad timeframe...wtf 2 months

Few weeks ago someone on gfy.com wrote:

---

I have money stuck in a merchant account. ;-\ I also have several payments my payroll person did the day/night of the freeze that never made it to performer accounts.

I was told that once the freeze was lifted (can legally be there up to 90 days) FCP plans on getting everyone's money back. No idea what will happen with the money that was being transferred when the freeze went into effect though. If it'll get pushed to the card, bounced back to my account or be lost in limbo.

I chatted with FCP support and they are saying they will do everything to give 100% of money to their account holders . But how can i trust them after all

I

im still workig but i m not receiving payments because im not verified in paxum and waiting for cosmopayment to send me card i keep tokens in my accountMiaaaa are you working for cb in this period or you finish?

SavannahMay

Cam Model

- Jun 10, 2011

- 83

- 83

- 103

- Twitter Username

- @savannahmay4u

- MFC Username

- savannahmay

- Chaturbate Username

- savannahmay

- ManyVids URL

- https://www.manyvids.com/Profile/44333/savannahmay/

I chatted with FCP support and they are saying they will do everything to give 100% of money to their account holders . But how can i trust them after all

They will do their best, but it gives no guarantees. Actually, it is not so important what the support says. They also say what they are told by their bosses: 'we understand the situation', 'we do our best', 'have patience', ... Those support guys do not know the exact details either. I think we know more than them because we approach Choice Bank directly. We now have several sources: Ad Kees, new source of Chriss and 'Caporaso and Partners'. Their stories are similar. I still have faith in it. That it will take so long does not mean anything.

write email to octav@paxum.com he verificate you in 1 hourI

im still workig but i m not receiving payments because im not verified in paxum

i have make this too

Thank youwrite email to octav@paxum.com he verificate you in 1 hour

i have make this too

i have try today some k dollars for the 1° time

but i want try wire transfer next time

but i have problem to contact support cb to give my codes

I WAS BEEN WAITING 15days for paxum verificate...

after i have write to that email and he make me verificate in 1 hour

but i want try wire transfer next time

but i have problem to contact support cb to give my codes

I WAS BEEN WAITING 15days for paxum verificate...

after i have write to that email and he make me verificate in 1 hour

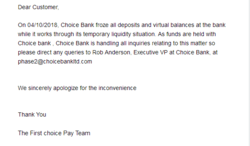

Does it mean that they are not responsible for our money anymore and we should bug choice bank to give us our money back????Finally something from FCP

View attachment 76058

Yes unfortunatelly i didntnoone warned me that money are not safe

Actually, I was warned by my CPA network just weeks before. They deactivated Fcp as a payment option because 'there were problems' and they wanted guarantees from fcp that everything was ok. A week later Fcp was available again as payment option. I thought it was a technical problem and I did not care about it anymore.

Finally something from FCP

View attachment 76058

It looks like they are in phase 2. Check email address.

What is phase 2?It looks like they are in phase 2. Check email address.

It confirms almost every speculation we had...unfortunately i doubt they can raise 25% more because i believe those 25 are milions in this case...im worried a bit for that strange time frame of 30.jun...because i red it somewhere that our cards will be valid till that date...strange coincidance...

I think it would be acceptable if they unfroze 75% soon and after few months gether the rest of it...:/

I think it would be acceptable if they unfroze 75% soon and after few months gether the rest of it...:/

It confirms almost every speculation we had...unfortunately i doubt they can raise 25% more because i believe those 25 are milions in this case...im worried a bit for that strange time frame of 30.jun...because i red it somewhere that our cards will be valid till that date...strange coincidance...

I think it would be acceptable if they unfroze 75% soon and after few months gether the rest of it...:/

June 30 is the end date of the Payoneer payment cards issued by Choice Bank. Some Payoneer customers now have 2 payment cards for 1 service. That is ok for a short period of time but not forever. That's why Payoneer has put an end date on it. That end date has not been communicated to Fcp customers.

75% now and 25% later is not possible. There are banking rules that must be followed. It is also not certain that everyone is going to cash out. What is currently happening (liquidity constraint) is also perfectly legal.

“Ad Kees <akees@choicebankltd.com>

12:07 PM (1 hour ago)

to me

Dear,

I do not know where you have that information from. We are unable to give reliable timeframes as of yet, so we did not.

The 75% reverts to the liquidity we had when we suspended wire transfers and card loads. That same message contained the statement that we expect to keep all clients whole.

So: once we have reliable information on timeframes we will inform you immediately.

Best regards,

Ad Kees

Vice-President Banking and Investment Services

Spain: “

Thats what i got as answer when i asked if its true that we might get only 75% of our money

Thats what i got as answer when i asked if its true that we might get only 75% of our money

This is what choice answered to me:

Thank you for reaching out to me.

We are currently unable to transfer funds or load cards. We are preparing a solution together with FCP in order to wire these funds to the clients directly. At this time I have no reliable timeframe for that. Once I do you will be informed immediately.

We are aiming to solve this within weeks.

I duly apologize for any inconvenience caused.

So, they hope to solve this within weeks...

Thank you for reaching out to me.

We are currently unable to transfer funds or load cards. We are preparing a solution together with FCP in order to wire these funds to the clients directly. At this time I have no reliable timeframe for that. Once I do you will be informed immediately.

We are aiming to solve this within weeks.

I duly apologize for any inconvenience caused.

So, they hope to solve this within weeks...

Last edited:

Wait...so what are legal rules? That bank in this kind of situation will not spread equaly the rest of money to all rather then on 1 2 3 go! Who is the fastest gets the most?!:/June 30 is the end date of the Payoneer payment cards issued by Choice Bank. Some Payoneer customers now have 2 payment cards for 1 service. That is ok for a short period of time but not forever. That's why Payoneer has put an end date on it. That end date has not been communicated to Fcp customers.

75% now and 25% later is not possible. There are banking rules that must be followed. It is also not certain that everyone is going to cash out. What is currently happening (liquidity constraint) is also perfectly legal.

I think we do not exist as individuals in choice bank..i believe we are all onder one client fcp...so lets hope they will be the fastests...

Someone mentioned Choice Bank is selling assets to increase their liquidity up to 75%. This doesn't mean that's how much of your funds you will get back. It's saying they are anticipating a bank run after they unfreeze accounts and have tried to prepare for that outcome. At 75% reserve ratio, they can handle a certain amount of panicked withdrawals before going bankrupt verses the 38% they had before the accounts freeze. We must assume they are still interested in staying in business. If they can somehow weather the bank run and stay in business, regain trust and get new deposits, they can then resume normal operations. In other situations like this, a larger more secure bank usually swoops in to buy the bank in trouble and give depositors the assurance that their money is still safe, preventing the bank run.

Hmmm... raise the 75%...Someone mentioned Choice Bank is selling assets to increase their liquidity up to 75%. This doesn't mean that's how much of your funds you will get back. It's saying they are anticipating a bank run after they unfreeze accounts and have tried to prepare for that outcome. At 75% reserve ratio, they can handle a certain amount of panicked withdrawals before going bankrupt verses the 38% they had before the accounts freeze. We must assume they are still interested in staying in business. If they can somehow weather the bank run and stay in business, regain trust and get new deposits, they can then resume normal operations. In other situations like this, a larger more secure bank usually swoops in to buy the bank in trouble and give depositors the assurance that their money is still safe, preventing the bank run.

They mentioned that they had 75% from the beggining of the boom... so let s hope for 100% or fck it i ll give them 5% just to give me the rest of the money

Hmmm... raise the 75%...

They mentioned that they had 75% from the beggining of the boom... so let s hope for 100% or fck it i ll give them 5% just to give me the rest of the money

My suggestion is get all you can out of Choice Bank. Then, all the people who took losses get together and file a class action lawsuit against Payoneer. I doubt Choice Bank will have anything left to be worth suing.

Someone mentioned Choice Bank is selling assets to increase their liquidity up to 75%. This doesn't mean that's how much of your funds you will get back. It's saying they are anticipating a bank run after they unfreeze accounts and have tried to prepare for that outcome. At 75% reserve ratio, they can handle a certain amount of panicked withdrawals before going bankrupt verses the 38% they had before the accounts freeze. We must assume they are still interested in staying in business. If they can somehow weather the bank run and stay in business, regain trust and get new deposits, they can then resume normal operations. In other situations like this, a larger more secure bank usually swoops in to buy the bank in trouble and give depositors the assurance that their money is still safe, preventing the bank run.

I agree. But can you explain why they put themselves in a liquid constrained position? Without this there's much less panic.

I agree. But can you explain why they put themselves in a liquid constrained position? Without this there's much less panic.

Since they never disclosed this information, I'm assuming the reason would have been panic inducing.

SavannahMay

Cam Model

- Jun 10, 2011

- 83

- 83

- 103

- Twitter Username

- @savannahmay4u

- MFC Username

- savannahmay

- Chaturbate Username

- savannahmay

- ManyVids URL

- https://www.manyvids.com/Profile/44333/savannahmay/

Is it an answer from phase2@choicebankltd.com?This is what choice answered to me:

Thank you for reaching out to me.

We are currently unable to transfer funds or load cards. We are preparing a solution together with FCP in order to wire these funds to the clients directly. At this time I have no reliable timeframe for that. Once I do you will be informed immediately.

We are aiming to solve this within weeks.

I duly apologize for any inconvenience caused.

So, they hope to solve this within weeks...

Does it mean that they are not responsible for our money anymore and we should bug choice bank to give us our money back????

Which is weird because we all have an account with Firstchoice / Payoneer but not as an individual with Choice Bank. Payoneer / Firstchoicepay do have a direct account and relationship with Choice Bank. So they should be the ones bugging Choice Bank. It looks like they are not even doing that now?

Payoneer forced us into Firstchoicepay and are responsible for the projects and partnerships they create. Therefor if it turns out that Choice Bank can only return a fraction of the funds stuck there, Payoneer should pay the difference to all of us.

No, from Ad Kees, emailed him directly as phase2 never answered. I also asked Ad if master cards we got from Payoneer and choice bank ever be loaded again or only wire transfer is possible to get money back, I asked him twice and he ignored that part of email twice.Is it an answer from phase2@choicebankltd.com?

June 30 is the end date of the Payoneer payment cards issued by Choice Bank. Some Payoneer customers now have 2 payment cards for 1 service. That is ok for a short period of time but not forever. That's why Payoneer has put an end date on it. That end date has not been communicated to Fcp customers.

If it's the case that Payoneer willingly planned to leave all FCP customers in the dark - first by creating this separate FCP label for adult business, then by moving away all their other accounts from Choice Bank only 2 months ago and finally by not communicating this last important end date information to their FCP customers when they did communicate it to their other customers months ago - Payoneer should be held responsible for all the mess their FCP customers are in.

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 11

- Views

- 2K

- Replies

- 11

- Views

- 4K

- Replies

- 21

- Views

- 3K

-

- Locked

- Replies

- 54

- Views

- 12K

- Locked

- Replies

- 11

- Views

- 2K

D